Two weeks ago Friday, according to Forbes an app called Clubhouse raised 12 million in financing at a post-money valuation of 100Million dollars. This is crazy when you consider that the app has no real users, aside from investor insiders. It’s been called amazing for the founders and company, but raising a ton of money at sky-high valuations can also spell disaster.

Raising too much money can ruin your business, your product, and your vision. Only time will tell if this was a brilliant move by the investors, Mark Andreesen, or a slip-up by the founders.

Lots of startups assume that there’s no such thing as raising too much money, after-all you need money. The crazy valuations can attract talent, buy fancy perks, and allows them to outspend on promotion, and customer acquisitions. But all these moves can lead the company astray and too much of a good thing can cause other issues.

Build a sustainable business

Too much money can cause you to overspend across the board. At first, this is a ton of fun, and companies who get over-funded go on a spending spree. They get fancy computers, standing desks, hire a ton of people, and often create multiple secondary teams working on secondary products or features. Sounds great, right?

Well, what happens is that the small team that was able to move quickly and get things done with 10 people, starts to drag with the weight of a larger organization. But the real problem is that the larger organization moves the profitability goal-posts.

Getting to profitability

A 10 person software team can get to profitability at just 1-2 million in revenue. A 100 person team may require 15-20 million in revenue to hit that break-even point. Suddenly the millions that you raised is running dry and you have to go back to investors to raise more money. This is where startups can get into even bigger trouble. If the last round was 100M valuation you will need to raise at an even higher valuation.

Two problems with this.

- #1 – You need to prove you’re worth it. Each time you jump in scale gets even harder. You need to have the product and customer traction to justify that price.

- #2 – Each time you do this you dilute yourself and you move the goal-posts move again. If your startup can’t grow fast enough, that just means raising ever-larger rounds. You hope to reach escape velocity while never turning a profit but this can also end in disaster.

How much is too much

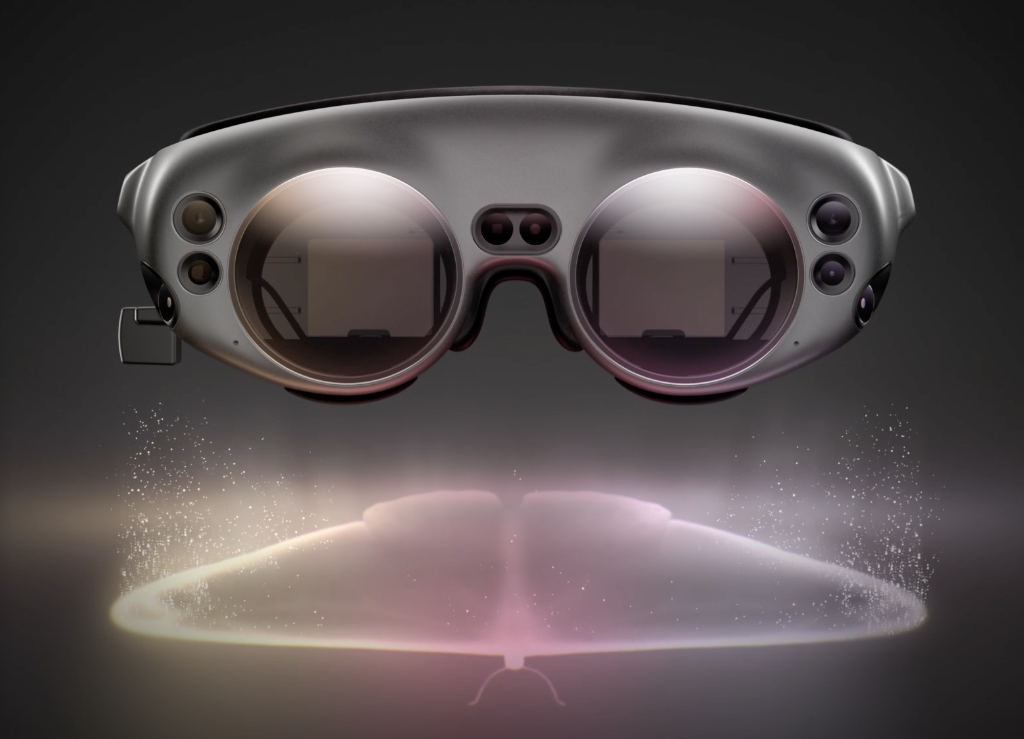

One recent example of this is Magic Leap. They raised 2.6B over 9 rounds of financing. They initially hoped to sell hundreds of thousands of headsets but have thus far reportedly sold just 6000. After years of trying to get adoption, they are both attempting to pivot into the enterprise and trying to be acquired. (unsuccessfully thus far).

Smaller startup teams have the advantage of moving quickly, being able to pivot, and actually ship product. As teams get larger companies will spend more time on operations and communication. Large companies have a harder time with rapid innovation and this size is a direct result of investors plowing too much money into a good idea.

Masking Fundamentals

Besides overspending and overhiring the other key problem is that having too much capital can mask fundamentals. Many startups famously create fake traction charts by over-spending on customer acquisitions. How do they do this?

Easy. Spend $1000 the first month on advertising. Spend $2000 the second month and so on….. hey look, our growth is going up each month. We must be growing like crazy! Well sure if your customer acquisition costs are reasonable but not everyone looks at this and some startups will spend hundreds of dollars to get a customer that’s worth a fraction of the costs.

Sometimes startups aren’t intentionally fooling investors, sometimes they are actually fooling themselves. Company problems can be masked with capital.

- Customers complain a lot – hire a customer support team to hide the problem.

- Too much customer churn and cancelations – hire a customer success and retention team to keep them around a bit longer

- If the product is terrible – hire a marketing firm to make a great promo video.

These things may look like they are helping but they are really masking the underlying issues. It costs less to fix the product and have a great design that customers love… but if you have a lot of capital you may have incentives to spend it in the wrong places.

Limiting your options for an exit

The other problem from raising too much capital is that it can limit your options down the road. Let’s look at two companies, both companies have built an amazing MVP and they go to investors looking for money.

- Company A asks for 1M to give their small team a year of runway to improve the product at a 5M valuation.

- Company B asks for 10M to significantly grow the team and spend on marketing and give it runway for 18 months at a 100M valuation.

One year later both companies get hit a wall. The tech is harder than it seemed, the market is more competitive but they are approached by a dream acquirer who wants to buy the business for $20 Million.

Company A, gave up 20% equity so they can walk away with $16 million dollar pay-day. The investors in company A made a 4x return on capital, not bad for 1 year.

The founders of Company B probably can’t take the deal. Not only is Company B much less profitable but worse… Even if they could accept such a deal they may get caught by a gotchya-clause called “liquidation preferences.”

These clauses in larger investment deals mean that the investor will agree to the higher valuation, as long as the startup agrees to give the investor a multiple on their money prior to selling. This may mean that the investor gets a minimum of 2-times his investment back prior to anyone else. In this example, if the investor had a 2X liquidation preference, all 20 million would go to the investor and the startup founders would be left with nothing.

Minimally Viable Capital

There’s a lot of press and attention to valuation and the size of funding rounds raised but the focus should be more on the sustainability and the long term potential of a startup. Founders should raise the minimum to give them security in the future and to bring them to long term sustainability and longevity.

Your equity and valuation don’t matter if your startup dies. Get to traction, get to product fit, get to awesome! Then, if your company truly has traction and is changing the world, go ahead. Negotiate amazing terms, raise money to grow your company even faster but be cautious because too much of a good thing could ruin your business.