I started my business in 2003 after leaving Microsoft and I grew my business to be one of the leading mobile development companies. I was working with a diverse set of companies around the world, building incredible technology. When I sold my business in 2017 I started to think about how I could give back to both the Boston community as well as other founders, leaders, and entrepreneurs.

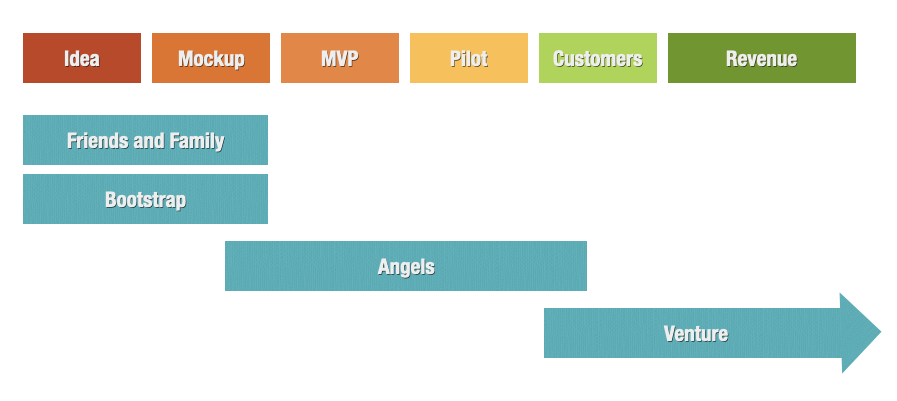

Angel investors are typically people who make investments from 5K-100K in early-stage companies. Companies at this stage typically have an idea, they have a team and maybe they’ve made some traction or progress but they need additional help to get to the next stage of growth. They often are too early for VC’s and don’t make enough to be profitable on their own… The TV show Shark Tank popularized some of the ideas but angel investing has been around since the late 1970’s, and most investors aren’t as predatory or quite as “sharkie”.

Angel investing isn’t adversarial and the drama that unfolds on TV in 15 minutes is often more complex and takes weeks to sort out in real life.

One of the reasons I wanted to give back and help other entrepreneurs and CEO’s is because entrepreneurship and being CEO is incredibly lonely. It’s an amazing job and really rewarding but being a successful leader means constantly solving problems and having the entire weight of a company on your shoulders. This is both exhilarating and incredibly stressful.

It also means that there aren’t too many people you can talk too. You can’t talk to your employees about your business problems and your family and friends wouldn’t really understand the challenges. No CEO knows all the answers and having good mentors and business partners and investors helps companies succeed along that journey.

Angel investors invest not just money but time and expertise in helping companies. Most importantly they can be a sounding board and compass for entrepreneurs blazing a trail.

Why don’t I just invest in the stock market? That seems a lot easier? It is a lot easier and a lot less risky. I do invest in the stock market but it’s also less rewarding. While I can make money in the stock market, I don’t really feel like I’m advising the founders and CEO’s. Elon, Bezos, Sundar, and Satya are probably having their own challenges but they haven’t called me up… Just sayin’.

As a CEO you don’t really like anyone telling you what to do because you like to run the show, and if your business has any success you definitely don’t want people telling you what to do. But you also don’t have a lot of people to bounce ideas off of.

The second reason is to make an impact. When you start a company, or run a company you’re solving a problem and in most cases you’re helping either people or other businesses. As a founder you can really only focus on one big problem at a time but as an angel investor you can participate and help multiple companies working on problems you care about. I’m interested in the environment, alternative energy, artificial intelligence, robotics, and more. Angel investing allows me to have an impact across a wide range of fields and technologies.

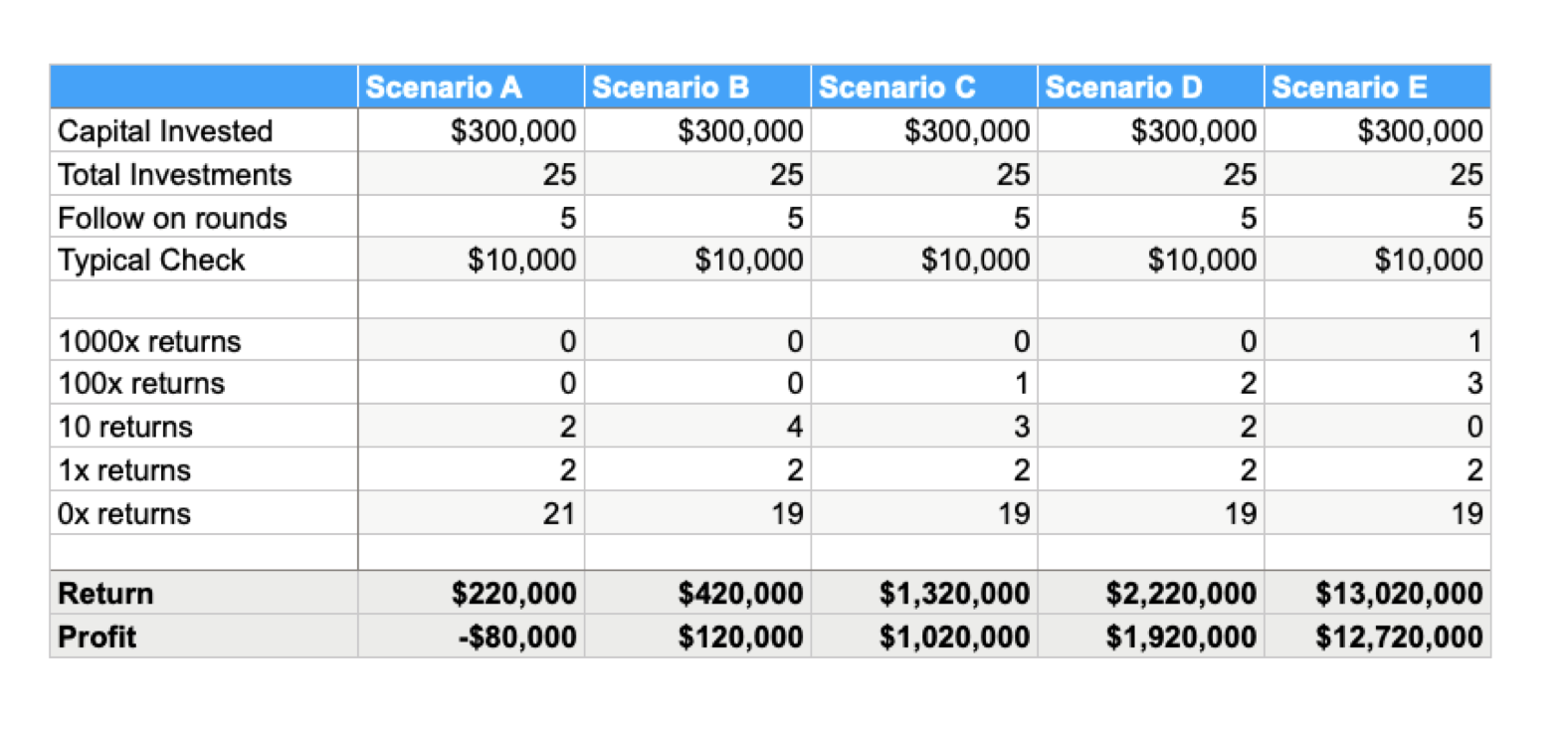

And lastly… Making money. Yes, making money is important but I list it last for a reason. Investing in companies takes time. You often don’t get your investment back for 7 or more years so short-term financial returns isn’t ideally suited for angel investing. The returns for an investment can range from losing your entire investment in a company to making a hundred times your investment. The range is very broad because many companies don’t make it.

If I invest in 25 early-stage companies I can expect that 21 won’t make it, two will do Ok, and if I’m lucky, one will be a huge hit. Lots of angel investors don’t make money and while my goal is to do better than average I think that only by understanding the models for success can I hope to do better.

So far we’ve hit three things:

- Helping founders

- Making an impact

- Financial returns…

And the reason that financial returns are important is that it can help more founders and make an even larger impact.

So, if you’re a startup founder, an entrepreneur looking for advice, funding or help. Please follow along, reach out, and let’s make something awesome!