Tesla, Apple, Google, Microsoft and Amazon are leading their fields in terms of innovation and if you’re interested in business or just making money in the stock market, pay attention because these five are doing something different. TAGMA is the new FAANG and it’s here to stay.

First, let’s start out with a premise, and that is that customer-centric companies that innovate outperform non-innovative companies.

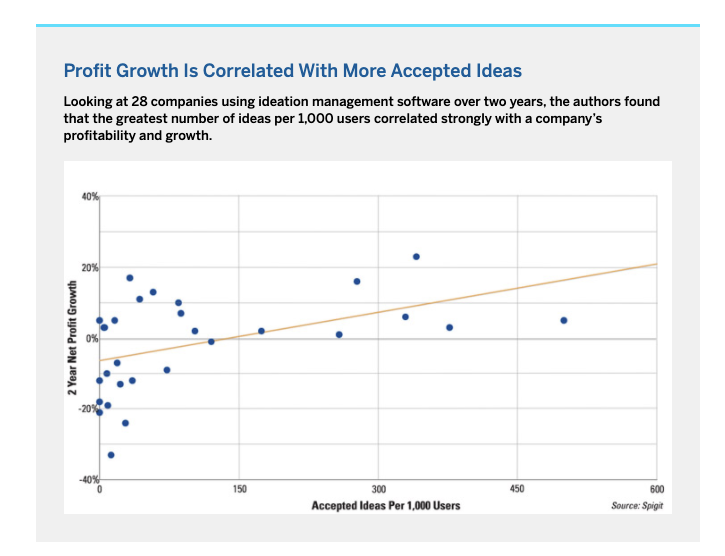

Is this true? Well, there’s research that shows that innovation can be correlated to company performance. A group from MIT looked at corporate ideation software (an overly expensive suggestion box) to see how many ideas were actually implemented and then looked at the performance of these companies to see how they did.

When there are few ideas implemented you have some winners and some losers but when you get to the right you have zero companies doing poorly when they are implementing the ideas of the organization.

Now a suggestion box is a good idea and this type of tool can lead to better communication and decentralized improvements across many parts of the company. Some of these suggestions may be small, but it’s not the size of the suggestion, it’s what you do about it that counts.

This is a small lens to use for large companies but small changes and innovations are good indicators that companies are open to larger changes, ideas and bigger, company pivots.

What’s this have to do with TAGMA and is it the new FAANG? I’m getting to that….

The S&P is changing

If you look at the S&P 500 it lists the largest 500 companies by market cap.

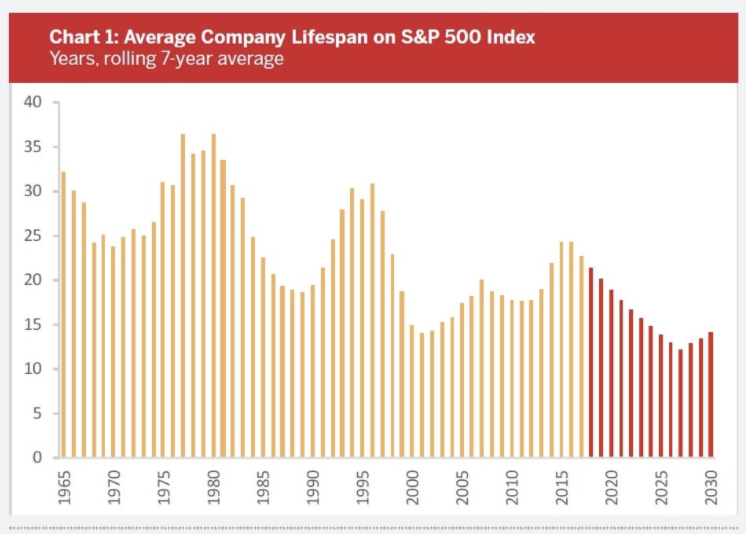

If you look at how long companies stay on the S&P 500 list, it’s changed dramatically.

In the 1980’s it was over 30 years for the average company to stay on the S&P 500. By the year 2000 it was 15 years and some think it will shrink even more. Firms keep slipping off and the average time on the S&P has gone from 20 years down to 7. According to this research into longevity 50% of the companies on the S&P500 today won’t be there in 10 years.

So to be a high-performing firm you need to innovate and to stay on the list you need to be able to reinvent yourself every few years.

That brings us to my list.

Tesla, Apple, Google, Microsoft and Amazon.

Let’s start with four of these. If you look at the composition of the S&P 500 by market cap, 20% of it is made up by Amazon, Google, Microsoft, Apple and Facebook. 20%! Ok, then, why isn’t Facebook on my list?

Why not Facebook?

Well… I started off by saying that our premise was that customer-centric companies that innovate outperform non-innovative companies.

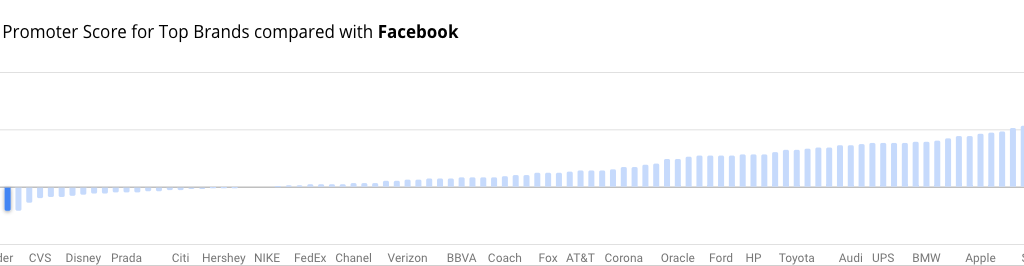

Now, don’t get me wrong. I have friends who work at Facebook and before I get angry emails, let me explain. While Facebook dominated their segment ofsocial media and the acquisitions of Oculus and Instagram were brilliant. Facebook just has a terrible reputation when it comes to customers.

They actually have a negative net promoter score… when you compare that to Apple, Amazon, Microsoft and Google, it’s not even close.

Why Tesla?

Ok, then but what about Tesla? Well, it’s not part of the S&P500? Why? Well, it hasn’t made the list yet. Tesla meets most of the criteria except for one. It needs to have positive reported earnings in the most recent quarter, as well as over the four most recent quarters. Tesla was supposed to hit that requirement but… global pandemic and all. If Tesla was on the list, it would likely be in the top 40.

The other reason I had it on my list is that unlike Netflix (a member of the FAANG club, who already destroyed Blockbuster) Tesla has a tiny fraction sliver of the market and lots of room to grow. Fast growing companies that are innovative grow up to be the next Apple’s and Google’s. No other company is growing like Tesla at scale.

Innovation wins in the long-term

For the last 10 years, I’ve personally invested in innovative companies and doing so I’ve consistently outperformed the S&P500 year, over year, over year. Now your mileage may vary but customer-centric innovation pays off; not just in terms of returns but in terms of positive impacts on society and the world.